The 1973 oil crisis began when members of the Arab Petroleum Exporting Countries Organization, led by Saudi Arabia, declared an oil embargo in October 1973. The embargo targeted countries believed to have supported Israel during the Yom Kippur War. The first countries targeted were Canada, Japan, the Netherlands, the United Kingdom and the United States, and the embargo later extended to Portugal, Rhodesia and South Africa. With the end of the embargo in March 1974, the price of oil rose by about 300% globally, from $3 to about $12 a barrel; US prices were significantly higher. The embargo caused an oil crisis, or “oil shock,” with many short- and long-term effects on global politics and the global economy. It was later called the “first oil shock”, followed by the 1979 oil crisis called the “second oil shock”.

Decline of American oil production and foreign dependency

In 1925, oil accounted for one-fifth of American energy use, but by the start of 1941, that proportion had risen to one-third. Oil has begun to replace coal as a preferred fuel source. It was used to heat homes, generate electricity, and was the only fuel that could be used for air transport.

In 1920, American oil fields accounted for about two-thirds of global oil production, and then up just over two-thirds by 1945. The United States was able to meet its own energy needs independently in the decade between 1945 and 1955. However, by the late 1950s it was importing 350 million barrels a year, mostly from Venezuela and Canada. By 1969, American domestic oil production could not keep up with increasing demand. In 1973, US production fell to 16.5% of global production.

Oil production costs in the Middle East were low enough for companies to make a profit, despite the US tariff on oil imports. This was hurting domestic oil producers in places like Texas and Oklahoma, which had to compete with cheap oil from the Persian Gulf region.

As long as Middle Eastern oil remained cheap, it was not possible for the United States to reduce Western Europe’s dependence on the Middle East.

Eventually, Eisenhower imposed quotas on foreign oil between 1959 and 1973. While US oil production declined, domestic demand was increasing at the same time, which led to inflation and the consumer price index, which rose steadily between 1964 and 1970.

Between 1963 and 1970, the US’s surplus capacity fell from 4 million bpd to nearly 1 million bpd, increasing its dependence on foreign oil imports. When Richard Nixon became president in 1969, work was done on removing quotas and changing tariffs. Deciding to keep the quotas through strong political opposition, Nixon imposed a cap on oil in 1971 as demand for oil increased and production fell. This practice increased the dependency on foreign oil imports as consumption was supported by low imported oil prices.

In 1973, Nixon announced the end of the quota system. Between 1970 and 1973, US crude oil imports nearly doubled, reaching 6.2 million barrels per day in 1973.

OPEC’s role

The Organization of the Petroleum Exporting Countries (OPEC) was founded on September 14, 1960 in Baghdad by five oil producing countries. The five founding members of OPEC were Venezuela, Iraq, Saudi Arabia, Iran and Kuwait. OPEC was organized because oil companies were selling below the announced oil price. Because the announced oil price was consistently higher than the market price of oil between 1961 and 1972.

In 1963, the Seven Sisters controlled 86% of the oil produced by the OPEC countries, but in 1970 their share fell to 77% with the rise of independent oil companies.

Increasing Soviet influence provided oil-producing countries with alternative means of transporting oil to markets.

Under the 1971 Tehran Price Agreement, the published oil price was increased and due to the depreciation of the US dollar against gold, some anti-inflationary measures took effect.

In February 1974, OPEC countries quadrupled the posted price to about $12.

OPEC soon lost its superior position, and by 1981 its production lagged behind other countries. Also, its member states were divided. Saudi Arabia was trying to regain its market share, increasing production and lowering prices. It reduced or eliminated the profits of high-cost producers.

After peaking at about $40 a barrel during the 1979 energy crisis, the “second oil shock,” the posted price dropped to less than $10 a barrel in the 1980s. Adjusted for inflation, oil briefly fell to pre-1973 levels. This sale price was unexpected for oil-importing countries, both developing and developed.

The Role of the US Dollar and the End of Bretton Woods

On August 15, 1971, the United States unilaterally withdrew from the Bretton Woods Agreement. Thus, the value of the US dollar was fixed to the price of gold, and the value of all other currencies was left to fluctuate, rising and falling according to market demand. As a result, depreciation of the dollar and currencies of other industrialized countries occurred. Because oil is priced in dollars, the real income of oil producers decreased.

This contributed to the “oil shock”. After 1971, OPEC was slow to readjust prices to reflect this depreciation. In September 1971, OPEC issued a joint statement stating that from then on they would price oil at a fixed amount of gold.

OPEC ministers had not developed institutional mechanisms to update prices in line with changing market conditions, so actual revenues were delayed.

Significant price increases from 1973-1974 returned prices and corresponding revenues largely to Bretton Woods levels for commodities such as gold.

The use of oil as a weapon and the embargo

Oil producing countries use oil as leverage to influence political events. For example, during the Suez Crisis in 1956, Syrians sabotaged both the Trans-Arab Pipeline and the Iraq-Banias pipeline, interrupting oil supplies to Western Europe.

Although some members of the Organization of the Arab Petroleum Exporting Countries (OAPEC), such as Algeria, Iraq and Libya, were said to support the use of oil as a weapon to influence the outcome of political conflicts; Saudi Arabia was said to be the strongest supporter of separating oil from politics.

In 1971 the United States was aware that the Arab states were intending to impose a new embargo.

On October 17, 1973, Arab oil producers cut production by 5% and the United States launched an oil embargo against the Netherlands, Rhodesia, South Africa and Portugal. Saudi Arabia also conditionally consented to the embargo. The embargo was accompanied by gradual monthly production cuts, with production reduced to 25% of September levels by December.

U.S. support for Israel’s frictions with Arab countries in the region had provoked the embargo, and the embargo contributed to a global recession and growing tensions between the respective countries’ U.S. and European allies. OAPEC demanded that Israel withdraw completely from all areas beyond the 1949 Armistice border.

The embargo lasted from October 1973 to March 1974. The result whether the embargo was successful or not is meaningful, Israeli forces did not return to the 1949 Armistice Line.

In the long run, the oil embargo has enhanced the nature of policy in the West by diversifying it in terms of increased exploration, alternative energy research, energy conservation, and fighting inflation.

The effects of the embargo were immediate. OPEC has forced oil companies to significantly increase payments. By 1974, the price of oil quadrupled from $3 per barrel to $12 per barrel ($75 per cubic meter). That is, it rose from US$17 to US$61 per barrel versus a price increase equivalent to 2018 US dollars.

This price increase had a dramatic impact on oil-exporting countries, as Oil-exporting Middle Eastern countries, long dominated by industrial powers, took control of a vital commodity and began to amass vast wealth.

Some of the revenue was distributed in the form of aid to other underdeveloped countries, and over 100 billions of dollars being used to fuel the ideological structures and arms purchases that have escalated political tensions, especially in the Middle East.

The embargo and production cuts by the Arab states, “Oil Control”, became the use of oil as a weapon. This Weapon was intended for the USA, UK, Canada, Japan and the Netherlands and these target countries perceived purely that the aim was to push them into a more pro-Arab position.

At the end of production, it was cut by 25%. However, the affected countries did not make dramatic policy changes.

In fact, the prospect of the Middle East becoming another superpower with the USSR was more of a concern to the United States than oil.

The embargo was not uniform across Europe. Of the nine members of the European Economic Community (EEC), the Netherlands faced a full embargo, Britain and France received supplies almost continuously, the other six faced partial cuts.

Although relatively unaffected by the embargo, the UK faced an oil crisis of its own anyway. A series of strikes by coal miners and railroad workers in the winter of 1973-74 was a major factor in the change of government.

Britain, Germany, Italy, Switzerland and Norway banned flying, driving and boating on Sunday. Sweden has rationed gasoline and heating oil. The Netherlands sentenced those who used more than their share of electricity to prison.

After a few months, the crisis subsided. The embargo was lifted after negotiations at the Washington Oil Summit in March 1974, but its effects lasted through the 1970s. The following year, the dollar price of energy rose again as the dollar’s competitive position in world markets weakened.

Price controls and restrictions in the United States

Price controls exacerbated the crisis in the US. The system limited the price of “old oil” while selling its newly discovered oil at a higher price to encourage investment. But old oil was withdrawn from the market and there were more shortages.

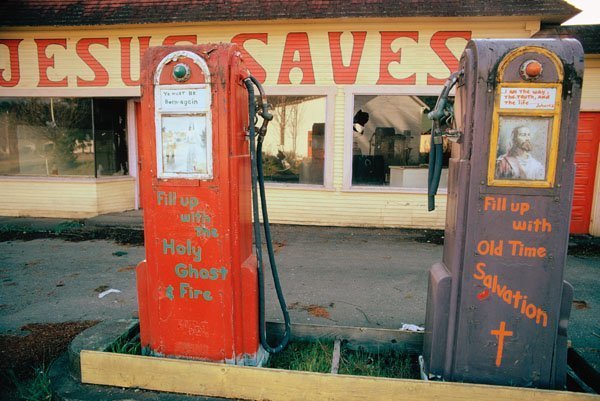

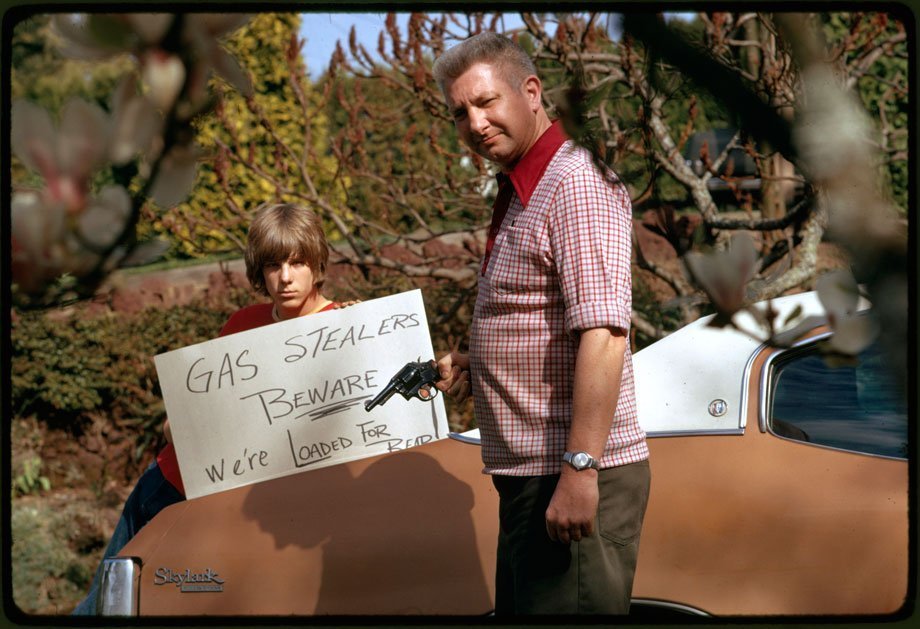

From the summer of 1972 to the summer of 1973, shortages and long queues were encountered at gas stations. The famine was tried to be eliminated by various methods.

- In 1974, the states were allocated as much domestic oil as each consumed in 1972. This worked for states that did not have a growing population, but fell short in other states where gas station lines were common.

- The odd-even license plate application allowed vehicles with an odd last digit (or special license plate) to purchase fuel only on odd-numbered days of the month, while others could purchase fuel only on even-numbered days.

- Some states used a tricolor flag system to indicate the availability of petrol at gas stations; green for unrestricted sales, yellow for limited/rated sales, and red for out-of-stock.

- Rationed sales application; In December 1973, the truck drivers’ strike against rationed sales led to violent incidents. In Pennsylvania and Ohio, non-striking truckers were hit by striking truckers, and in Arkansas, non-striking trucks were bombed.

- The maximum speed limit of 55 mph (approximately 88 km/h) was implemented in 1974 to help reduce consumption; On November 28, 1995, President Bill Clinton signed the National Highway Designation Act, which ended the 55 mph (89 km/h) speed limit that allowed states to revert to previous maximum speed limits.

- Strategic Petroleum Reserve was developed.

- Daylight saving time was implemented.

- Famous auto racing groups voluntarily implemented savings methods.

- In 1975, the Energy Policy and Conservation Act was passed and Corporate Average Fuel Economy (CAFE) standards were developed, requiring fuel economy for cars and light trucks.

- In 1976, Congress created the Weatherization Assistance Program to help low-income homeowners and renters reduce their demand for heating and cooling through better insulation.

- By 1980, automobile manufacturers began to offer higher efficiency cars to consumers.

- The energy crisis has led to increased interest in renewable energy, nuclear energy and domestic fossil fuels.

Macroeconomics

The crisis was a major factor in pushing Japan’s economy away from oil-intensive industries. Investments shifted to sectors such as electronics. Rising fuel costs allowed small, fuel-efficient car models to gain market share from competition with the United States and triggered a decline in American car sales that lasted until the 1980s.

Western central banks decided to cut interest rates sharply to stimulate growth and decided that inflation was a secondary concern. The resulting stagflation made economists and central bankers well experienced. Economies have become more resilient to increases in energy prices.

The price shock created large current account deficits in oil-importing economies. A petrodollar recycling mechanism was created, in which OPEC surplus funds were channeled to the West to finance current account deficits through capital markets. The operation of this mechanism required the loosening of capital controls in oil-importing economies and opened the gates of western capital markets to grow exponentially.

In 1974, seven of the top 15 companies on the Fortune 500 list were oil companies, down to four in 2014.

International relations

The crisis had a major impact on international relations and created a rift within NATO. Some European countries and Japan have tried to separate themselves from US foreign policy in the Middle East so as not to be targeted by the embargo. Arab oil producers, attributed a future policy change to peace between the warring parties.

America’s Cold War policies took a big hit from the embargo. While they focused on China and the Soviet Union, they faced the covert Third World challenge to US hegemony.

The US was so disturbed by the rise in oil prices and the challenge of the underdeveloped countries that in late 1973 military action was brought to the agenda to seize the Middle East oil fields by force.

NATO

Western Europe began to move from pro-Israeli policies to more pro-Arab policies. This change put the Western alliance in trouble. The United States remained committed to Israel.

With the embargo imposed, many developed countries changed their policies regarding the Arab-Israeli conflict. Among them were members of the United Kingdom and the European Community.

After the dissatisfaction with Canada’s mostly neutral position expressed, Canada moved to a more pro-Arab position.

Japan

Despite having no historical links to the Middle East, Japan was the country most dependent on Arab oil. In 1970, 71% of the oil it imported came from the Middle East. As a result of pressure from Arab countries, Japan argued that Israel should withdraw from all 1967 territories. It declared that Palestine had the right to self-determination, threatened to revise its policy towards Israel if these conditions were not accepted, and was recognized as an Arab-friendly state.

Nonaligned nations

A dissident Latin American bloc was organized and financed in part by Venezuelan oil revenues, which quadrupled between 1970 and 1975.

A year after the embargo began, the UN’s nonaligned bloc passed a resolution demanding the creation of a greater “New International Economic Order” where nations in the global South would receive a larger share of the benefits from the exploitation of southern resources.

Arab states

Before the embargo, geopolitical rivalry between the Soviet Union and the United States, combined with low oil prices that hampered the necessity and feasibility of alternative energy sources, provided the Arab States with financial security, and disproportionate economic growth.

The oil shock disrupted the status quo relations between Arab countries and the USA and USSR. At that time, Egypt, Syria, and Iraq were allied with the USSR, while Saudi Arabia, Turkey, and Iran (plus Israel) were allied with the United States. Fluctuations in harmony often finaized in greater support from the superpowers involved.

Automobile production and fuel consumption

Big, heavy and powerful cars were popular in the US before the energy crisis. Fifteen years before the 1973 oil crisis, gasoline prices in the US lagged far behind inflation.

The crisis has reduced the demand for big cars. Japanese import cars featured four-cylinder engines that were more fuel efficient than the typical American V8 and six-cylinder engines, and these became mass market leaders with unibody construction and front-wheel drive becoming the de facto standards.

Since some buyers complained about the small size of the first Japanese compacts, vehicles with dimensions, comfort and features appealing to US vehicle users were produced and presented to the US market.

Vehicles imported from Europe were also produced with similar qualities and took a share from the US market.

Most of the cars made in Western Europe were smaller and more economical than their American counterparts. After World War II, most Western European countries levied taxes on vehicle fuel to limit imports. But by the late 1960s, rising revenues supported increasing car sizes.

US domestic manufacturers also updated themselves and produced substitute vehicles, ending their captive import policies.

Economic imports were successful as well as heavy and expensive vehicles. In 1976, Toyota sold 346,920 cars (average weight around 2,100 pounds), while Cadillac sold 309,139 cars (average weight around 5,000 pounds).

Diversification of oil resources

The embargo encouraged new areas for energy research, including Alaska, the North Sea, the Caspian Sea, and the Caucasus. Explorations in the Caspian Basin and Siberia turned out to be profitable. Cooperation became even more hostile as the USSR increased its production. By 1980, the Soviet Union had become the world’s largest producer.

Relying on price elasticity to sustain high consumption, OPEC underestimated the extent to which other sources would reduce demand. Nuclear power and natural gas power generation, natural gas home heating, and ethanol blended gasoline have all reduced oil demand. Some of OPEC’s economic and geopolitical power has shifted to alternative energy sources.

Economic impact

The fall in prices posed a serious problem for oil-exporting countries in Northern Europe and the Persian Gulf.

Densely populated, poor countries such as Mexico, Nigeria, Algeria and Libya, whose economies are heavily dependent on oil, were not ready for such a market that left them desperate.

In the mid-1980s, when declining demand and increased production clogged the world market, oil prices fell and the cartel lost its unity.

Mexico (non-members), Nigeria and Venezuela, whose economies had expanded in the 1970s, were on the verge of bankruptcy, and even Saudi Arabia’s economic strength was significantly weakened. Divisions within OPEC have made it more difficult to act and develop in concert.